Demand for basic wearables, defined as wearable devices that don’t run third-party apps by International Data Corporation (IDC), is slipping.

In the second quarter of 2017, vendors shipped 26.3 million wearables worldwide, a 10.3 percent year-over-year increase, said IDC. Shipments of basic wearables dropped slightly (0.9 percent decline), a first for the segment while the smartwatch category shot up.

Bolstered by improving Apple Watch and Android Wear sales, smartwatch shipments jumped 60.9 percent in Q2 on an annual basis, the research firm discovered.

“Smartwatches recorded double-digit year-over-year growth, with much of that increase attributable to a growing number of models aimed at specific market segments, like the fashion-conscious and outdoor enthusiasts in addition to the technophile crowd, lower price points, and a slowly-warming reception from consumers and enterprise users alike,” said IDC research manager Ramon Llamas, in a statement. “Factor in how smartwatches are taking steps to become standalone devices, and more applications are becoming available, and the smartwatch slowly becomes a more suitable mass market product.”

Once considered “gateway” wearables, fitness trackers are losing ground to smartwatches, IDC noted. Whereas GPS tracking and advanced health monitoring capabilities were once considered niche features, they are now becoming part of the stock smartwatch experience.

Other fast-growing segments include smart clothing and earwear, Llamas said. Both notched triple-digit growth in Q2, although it’s early days and these products typically cater to a specific clientele, like professional athletes in the case of smart clothing.

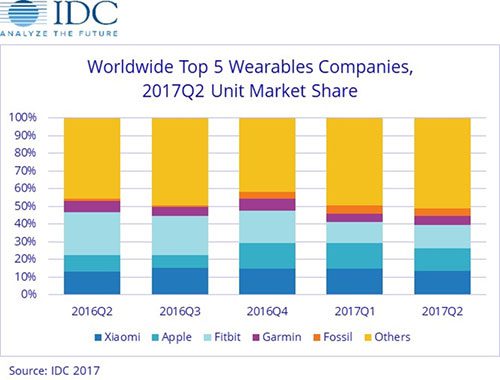

The wearables race is also a tight one, according to IDC’s wearables vendors rankings.

Xiaomi is the top wearable device company, having shipped 3.5 million devices and captured 13.4 percent of the market. Second-place Apple shipped 3.4 million Watches and claimed 13 percent market share. Wearables pioneer Fitbit took third place with shipments of 3.4 million units and a 12.9-percent share of the market.

This week, Fitbit signaled a shift from its basic fitness-tracking roots by unveiling Ionic ($299.95), a new smartwatch that supports third-party apps. Available in October, the Iconic’s App Gallery will feature apps from Pandora and Starbucks, among others.

But don’t expect Fitbit to soften its focus on fitness.

“With Ionic, we will deliver what consumers have not yet seen in a smartwatch – a health and fitness first platform that combines the power of personalization and deeper insights with our most advanced technology to date, unlocking opportunities for unprecedented health tracking capabilities in the future,” James Park, co-founder and CEO of Fitbit, said in an Aug. 28 announcement.

Pedro Hernandez is a contributing editor at Datamation. Follow him on Twitter @ecoINSITE.